Navigating government compliance can be a daunting task—especially when it comes to registering Special Purpose Machines (SPMs) with the Bureau of Internal Revenue (BIR). Whether you’re running a hotel, a restaurant, or a resort club, staying compliant is not optional. It’s essential.

But first—what exactly is an SPM?

A "Special Purpose Machine" (SPM) under the Bureau of Internal Revenue (BIR) refers to machines used for internal purposes or that generate supplementary invoices/receipts but not sales invoices/official receipts.

In 2023, the BIR implemented updated rules for accrediting and registering sales machines like POS systems, CRMs, and SPMs, to streamline the process and enhance transparency. This move is part of their broader push for digitalization and improved tax monitoring.

This guide breaks down the updated process for registering your SPM—from online applications to document requirements—based on the latest BIR guidelines. Let’s help you stay ahead, stress-free, and fully compliant.

What are the four main steps in registering your Special Purpose Machine?

1

Create an account on eAccreg

2

Branch Application

3

SPM Permit Application

4

PTU Generation

How to create an eAccreg account

What is eAccreg?

The eAccReg system is an online platform created by the BIR in 2014. It allows businesses to submit and process applications for using Cash Register Machines (CRMs), POS systems, and Special Purpose Machines (SPMs).

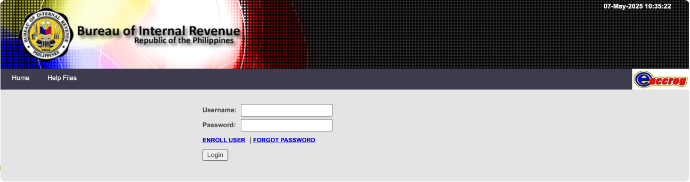

Step 1

Go to https://eaccreg.bir.gov.ph

Click on ENROLL USER

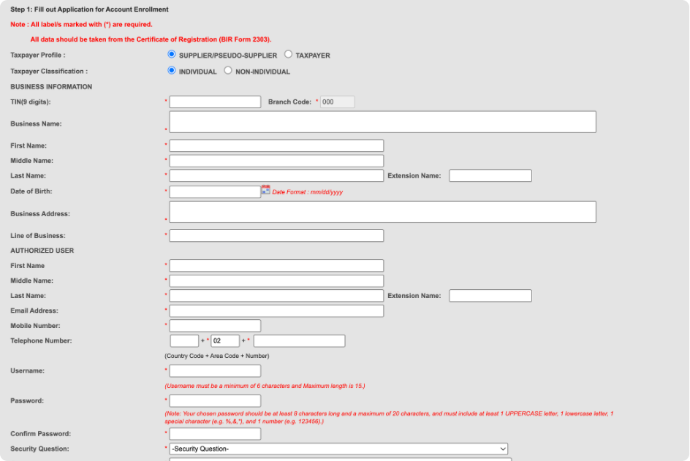

Upon clicking ENROLL USER, you will see the Application for Account Enrollment page.

Step 2

Upon clicking ENROLL USER, you will see the Application for Account Enrollment page.

Reminders

- On the Taxpayer Profile field, tick TAXPAYER.

- On the Taxpayer Classification field, if the Taxpayer is an individual/single proprietor, tick INDIVIDUAL; if a company, select NON-INDIVIDUAL

- Please ensure that you have a copy of the Head Office's / Taxpayer's BIR CERTIFICATE OF REGISTRATION/COR (BIR FORM 2303) with you when you are doing actual online application. Make sure that the details in the said COR BIR Form 2303 are THE SAME as what you will input online

- On the Authorized User fields, please input details of the employee you will authorize/designate to use eAccreg.

Step 3

Wait for BlR's email saying "You have successfully submitted your application for Account Enrollment" with transaction number.

Step 4

Upon receipt of BlR's e-mail, submit the following documents to LTAD or LTDO or RDO within three (3) working days:

- "Application Letter" for Head Office/Account Enrollment (Optional)

- "Annex A - Sworn Statement" (Notarized)

- "BIR Authorized User Form" or "Authorization Letter"

- Head Office/Taxpayer BIR Certificate of Registration (COR) - BIR Form 2303

- Securities & Exchange Commission (SEC) Certificate of Registration

- Photocopies of two (2) Valid IDs

- Company ID & another valid ID with photo & signature of an authorized signatory (President or Owner) or an authorized representative.

Reminders:

- NCR Large Taxpayers - Submit to Large Taxpayer Assistance Division (LTAD), BIR Head Office

- Provincial Large Taxpayers - Large Taxpayer Division Office (LTDO)

- For Non-Large Taxpayers - Revenue District Office (RDO)

- Failure to submit requirements within three (3) working days from receipt of the email notice will forfeit online account application. You will have to apply again online.

What is a large taxpayer? A taxpayer whose gross sales for taxable year is one billion pesos (1,000,000,000.00) or more (RMC No. 113-2024).

Step 5

Wait for another email from BlR LTAD/LTDO/RDO saying your application has been approved.

Step 6

Upon receipt of second email, you may now proceed with online "Branch Application"

Branch Application

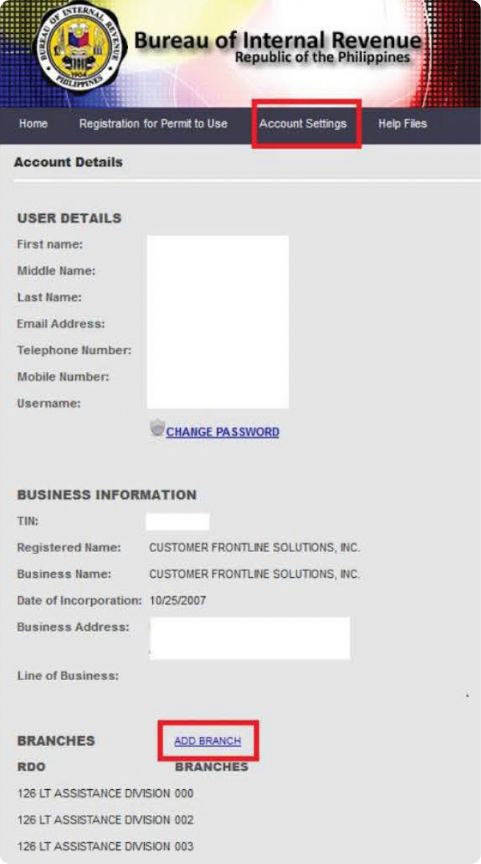

Step 1

Log-in to eAccreg using your username and password.

Step 2

To apply for a branch, click Account Settings, then Add Branch

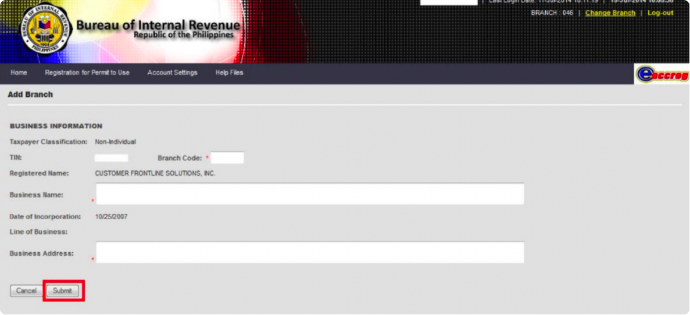

Step 3

Encode the details like Branch Code, Business Name, and Business Address found on the Branch's BIR Certificate of Registration (COR). Then click Submit.

Step 4

A window will then appear indicating Transaction Number. Please note down the issued Transaction Number per Branch.

An email will also be received confirming your application.

Reminders:

- Please ensure that you have a copy of the Branch's BIR CERTIFICATE OF REGISTRATION/ COR (BIR FORM 2303) with you when you are doing actual Branch application.

- Make sure that the details in the said Branch COR BIR Form 2303 are THE SAME as what you will input online.

- If your business has no branches, you still have to accomplish this step for your head office.

Step 5

Within 3 to 4 working days from receipt of BlR's email, submit the following documents LTAD or LTDO or RDO:

- "Application Letter" for Branch Enrollment (Optional)

- "Annex A - Sworn Statement"

- "List of Branches" with the following information: Branch Code; Branch Name; Address; and Transaction Number Issued.

- Photocopy of previously submitted Account Enrollment Application Letter (Optional)

- Photocopy of previously submitted Authorized User Form

- Photocopies of two (2) Valid IDs

- Company ID & another valid ID with photo & signature of an authorized signatory (President or Owner) or an authorized representative

Reminder:

Failure to submit requirements within three (3) working days from receipt of the email notice will forfeit the branch application. You will have to apply again.

SPM Permit Registration

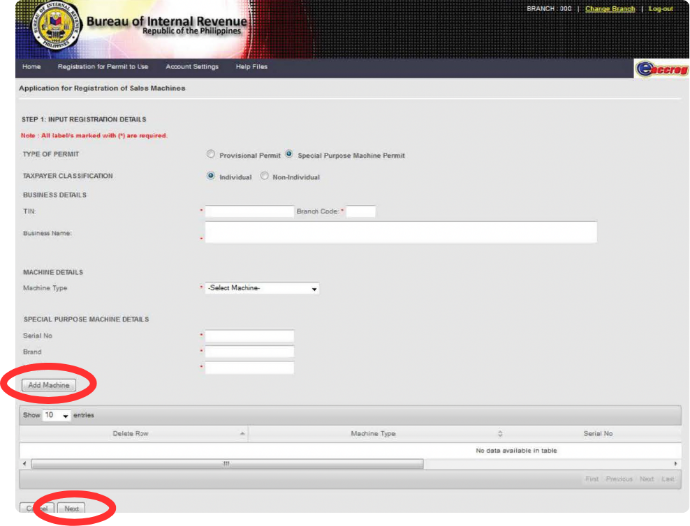

Step 1

Click Registration for Permit to Use, then Encode Application

*Excel template for bulk uploads (and other BIR templates) can be downloaded here

Step 2

Fill-in the required details, then click Add Machine:

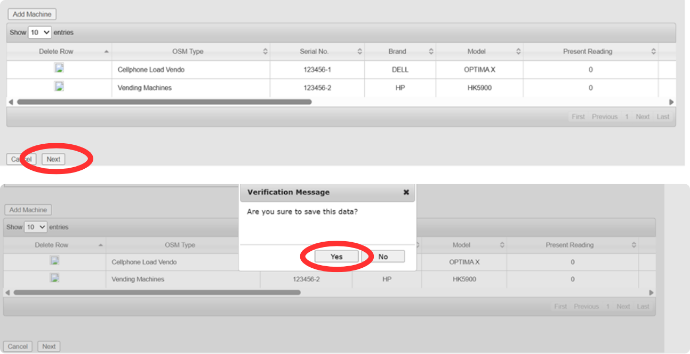

Step 3

List of machine/s will appear below.

Click Next, and then Yes to confirm save of data.

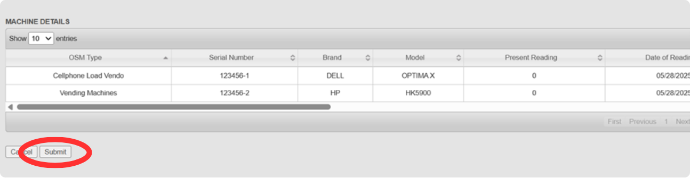

Step 4

If the details are correct, click Submit.

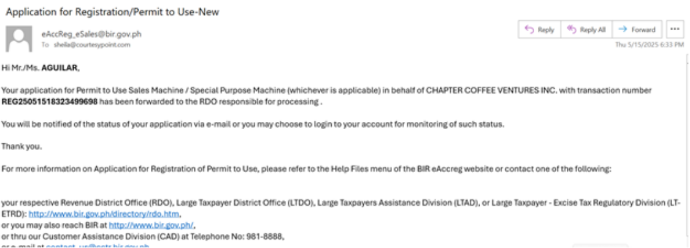

Step 5

You’ll receive an e-mail regarding the approval of your SPM registration

Reminder:

Please be ready with your PC/machine serial number/ brand /model information when you do this particular step. The serial number is at the back of the CPUs.

PTU Generation

Step 1

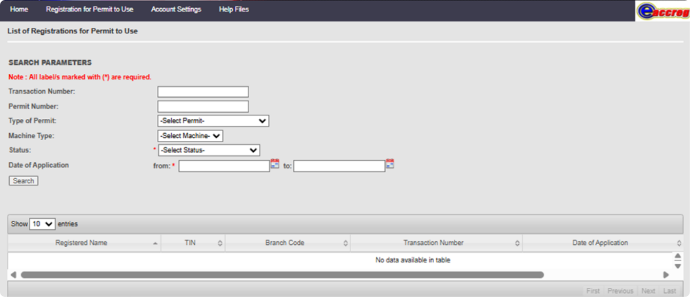

Click Registration for Permit to Use > List of Registration of Permit to Use

Step 2

- Select Status: All

- Date of Application: Choose the range

- Click Search

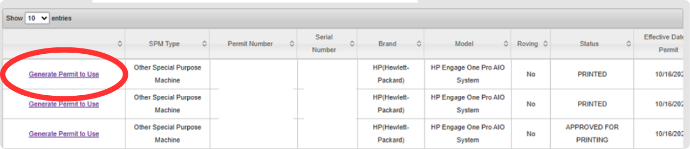

Step 3

If the status is Approved for Printing, click on Generate Permit to Use to download permit

Join our FREE webinar, Courtesy Tech Update: Your Guide to Special Purpose Machine (SPM) Registration with BIR to learn more!

If you are still on the market for a BIR-accredited POS, we would like you to check Presto, our BIR Accredited Point-of-Sale System and ERP rolled into one. Why choose a BIR accredited POS?

- Full Compliance with Tax Regulations

- Accurate and Transparent Sales Reporting

- Avoidance of Tax Penalties and Legal Issues

- Automated Receipt Printing (Compliant with BIR Format)

- Builds Trust with Customers

- Easier Audits and Government Inspections

- Security

- Localization

- Peace of Mind

Learn more about the features of Presto here.

Send us an e-mail to schedule a free demo at sales@courtesypoint.com